Manage prevailing wage, Davis-Bacon and union payrolls with automatic calculations and minimal entry. While many construction crews are smaller teams that operate locally, some are larger outfits, licensed to operate across state lines. With the increased size and operational area comes added complexity, as labor laws vary from city to city and state to state, and tracking all of that manually can become prohibitively time-intensive. Ever the financial solution juggernaut, QuickBooks has a reputation for being comprehensive and virtually exhaustive in its list of features, functions and supported use cases. It’s known throughout the professional sector as an easy-to-use solution, and it’s often used by small businesses. It’s also known as a more pricey option, but one with features to match the added cost.

QuickBooks Payroll: Best for QuickBooks Accounting Users & Low-cost Contractor Payments

- These tools can help ensure that employees are accurately recording their hours worked, even when they are working remotely or on-the-go.

- What sets it apart from the other payroll systems we reviewed is its new hire reporting for contractors and employees (the other construction payroll solutions on our list only report new employees to the state).

- Even from its logo, eBacon communicates who the target market for the software is.

- Efficient payroll designed for construction can help you save time and money by making calculations easier, filing accurate taxes and reports, and organizing job costs.

Payroll4construction is an online payroll service, geared towards doing payroll for construction companies. The best way to stay on top of your construction payroll, ensure you are compliant, and reduce the likelihood of mistakes is to use a dedicated construction payroll service. These services can reduce the burden for the following construction payroll complexities. Construction workers often have different wage rates based on their roles, experience, and job sites. A generic payroll system may struggle to handle these complexities, leading to mistakes and frustration. Payroll software typically includes an online portal accessible to employees and contractors where they can conveniently view pay stubs and year-end tax forms.

- For example, an electrician may earn an hourly wage on one site but a different rate on another site.

- However, it is a detailed time-tracking solution that collects and maintains all the necessary data to help you run payroll.

- We collect the data for our software ratings from products’ public-facing websites and from company representatives.

- ADP Workforce Now is a cloud-based payroll and HR solution that offers a range of features for construction companies.

- Any misstep in the process and you’ll face angry employees and the scorn of the IRS.

Payment Options

- With Knowify, you can easily access the information you need, when you need it.

- This system allows contractors to track a job’s labor alongside work breakdown, cost breakdown, and schedule.

- In that room, we could say, we spent $3,000 of payroll today but we also cleared 300 square feet, which means that we’re spending $10 a square foot to clear all this land.

- The construction industry carries some special circumstances that may make these same solutions a poor fit.

- This serves a crucial business function because calculating an employee’s take-home pay isn’t as simple as just tallying up hours worked and multiplying it against their hourly rate.

- Fortunately, they can ease the burden with sophisticated construction payroll software.

It removes the administrative burden of payroll by automating the process, which means no syncing or importing data and no waiting to close pay periods. While by far the most expensive, eBacon made it to the top of our list because its features are designed specifically for construction companies. It offers certified payroll, compliance reports, fringe benefit management, union pay management, and more. EBacon provides all the tools you need to meet the needs of government contracts but works just as well for private jobs. Efficient payroll designed for construction can help you save time and money by making calculations easier, filing accurate taxes and reports, and organizing job costs. The best construction payroll software has specific reports and job codes for the construction industry.

How is workers’ compensation calculated?

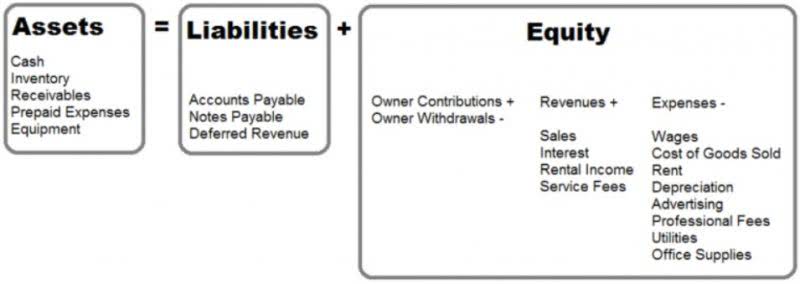

Since no two projects are ever the same, each job site will have unique schedules, conditions, tasks, and multiple pay rates. So as you can see, determining gross wage is only the beginning, but it’s a crucial step as it serves as the foundation for all other payroll calculations to follow. Only after including things like overtime and benefits and deductions like taxes and pension contributions can you arrive at net wages (which is what you’re really after). A construction payroll is a list of all employees used to calculate total earnings for time worked. This serves a crucial business function because calculating an employee’s take-home pay isn’t as simple as just tallying up hours worked and multiplying it against their hourly rate. HCSS HeavyJob isn’t payroll software, but it does ensure the accuracy of your payroll by allowing workers to manage jobs and timecards in the field.

Top Payroll Services for Construction

Most online payroll services offer numerous payment methods, including direct deposit, paper checks and prepaid debit cards (or pay cards), to better accommodate the needs and preferences of your workforce. Paycor’s user-friendly HR tools make it an excellent option for businesses that work with independent contractors. It streamlines https://www.bookstime.com/ and simplifies complicated tasks, like hiring new freelancers and creating detailed payroll reports. We like that Paycor’s easy-to-navigate system offers helpful tips as you work on the platform. For example, it helps you correctly classify workers as W-2 versus 1099 so you don’t make costly mistakes when bringing in new contractors.

- However, payroll is more than cutting a check to your employees every two weeks.

- Managing construction projects requires the ability to quickly respond to changes in material costs and accurately scope projects and labor.

- With the prevalence of the construction labor shortage, companies are in high competition for skilled workers.

- Applying appropriate paid time off, benefits, and overtime pay rates is complicated enough, but certain aspects of construction projects can make payroll even trickier.

- Adopting construction payroll software delivers a number of business-enhancing benefits.

- Not only will it help to cut costs by providing accurate project reports and tax filings, but it will also help to provide vital documentation and facilitate discussions with union leaders.

In our evaluation, Gusto scored 4.14 out of 5 with high marks in nearly all criteria. It lost points because its multi-state payroll feature is available only in higher tiers and Gusto lacks the specialized features for construction that you can find with eBacon and Payroll4Construction. Unlike ADP Run and QuickBooks Payroll, its health plans are unavailable in 12 states. Nonetheless, if you are a small business that doesn’t do a lot of government contracts or union work, its reasonably priced plans and user-friendly tools make it a good choice. With job costing and tracking, you can assign specific costs to each job or project, allowing you to see how much money is being spent on labor for each one. This information can be invaluable when it comes to budgeting and forecasting, as well as identifying areas where you can cut costs or improve efficiency.

Contact us today to learn how Deltek ComputerEase can help you to boost your profitability. Complexities such as prevailing wage work, outsourcing and submitting reports, and construction reporting can quickly become overwhelming. To see the full range of services provided by IDES, and for the latest news concerning the department, visit IDES.Illinois.gov. In June of 2010, Greg Carroll started Empire Construction Management Services in New York. His New York construction company currently works on many infrastructure projects in the area of construction administration, construction field and site management services. These ratings are meant to provide clarity in the decision-making process, but what’s best for your business will depend on its size, growth trajectory and which features you need most.

Time tracking from the field

Vendors with international payment capabilities are ideal for businesses with global operations and independent contractors across borders. However, we were disappointed that Paycor’s lowest tier has limited support for wage garnishments and doesn’t include features like 401(k) integration and job costing. However, this may not be a concern if your business primarily has a freelance labor pool, as those functions are more relevant to W-2 employee payroll needs. For those seeking more comprehensive HR solutions, higher-tier plans offer additional features.

Try to find systems that work together so you can use your data effectively for job costing, scheduling, invoicing, and more. Using a checklist can serve as another line payroll for construction companies of defense, ensuring you and your bookkeeper don’t miss any steps. Your list is also a checkpoint, allowing you to quickly identify missed and problematic steps.

Leave a Reply